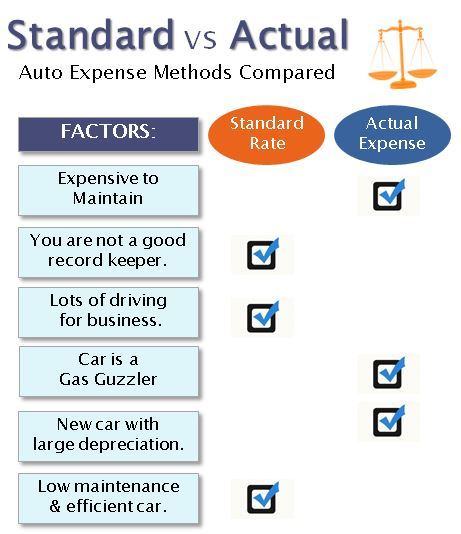

There are 2 methods the IRS allows you to use as a small business professional to deduct your auto expenses. The “Standard” or “Actual” method. Which method is right for you?

This chart may help:

IMPORTANT TAX TIPS:

For a Car you OWN: use the standard mileage rate for the first year your vehicle was in service. After that, you can calculate both methods and use whichever gives you a larger deduction. Remember: if you use the actual expense method the first year, you must use it for the life of the vehicle.

For a Car You LEASE: If you use the standard mileage rate for a car you lease, you must use it for the entire lease period. You cannot switch methods on a lease.

For the current standard IRS auto deductions rate click here

“Pay It Forward” and feel free to pass this blog post along to any agents it may help.

Recent Comments