Many small business professionals, such as Real Estate Agents, will typically spend a good part of the day in their vehicle conducting business in the local market… this article will discuss what is considered a deductible local business trip?

Costs of local travel are deductible if:

- They are ordinary and necessary for your business

- The cost is common, helpful, appropriate for business

- Not considered a “commute” (from home to office)

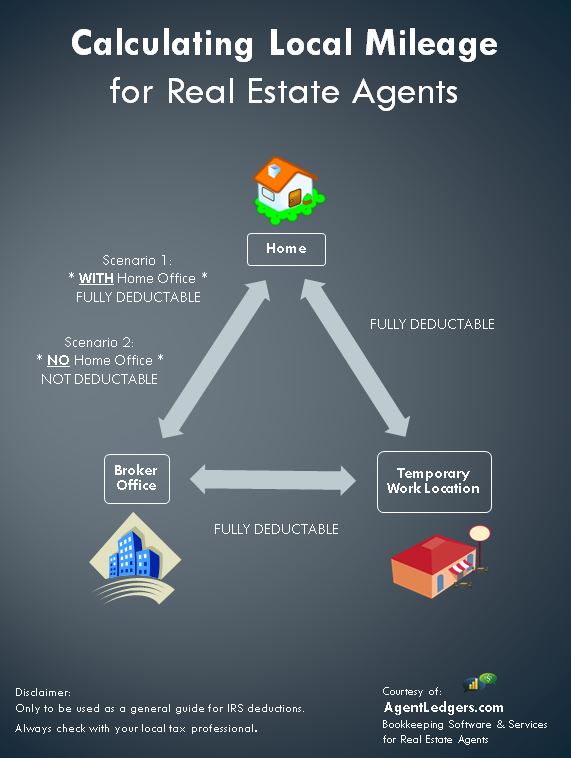

This chart may help:

A Few Notes and Explanations:

Home Offices and Commuting (2 Scenarios):

#1: If you do not have a home office that qualifies as your principal place of business, then all trips made between your home and your brokerage office are considered commutes and are not deductible.

- Stopping at a work location on a commute makes the entire trip into a deductible expense.

- Putting a business sign in your car window will not allow you to deduct a commute.

- Talking with clients on the cell phone during will not allow you to deduct a commute.

#2: If you have a home office that qualifies for the home tax deduction, you can deduct trips from your home to another business location. Business trips from your home office to any temporary work-related location, (including the brokerage office) are fully deductible.

FOR IRS Bulletin click here

Trip Examples:

You CAN Deduct when:

- driving from home office to brokerage (when home office IS your principal place of business)

- driving to properties

- driving to open houses

driving to meet clients (except if considered a commute from home to your broker office) - driving to deal with offers

- driving to real estate training

- driving to do business banking

- driving to buy business supplies

- use of your car by another person for something connected with your business

You CANNOT Deduct when:

- Commuting from home to your brokerage office

(when home office is NOT your principal place of business) - trip to the grocery store for personal shopping

- trip to church or club meeting for personal reasons

- for any trips unrelated to business

- commutes are not deductible because you make business calls on your cell phone on the route.

LEGAL CASE IN POINT: click here for details

https://www.ustaxcourt.gov/InOpHistoric/moorewilliej&thelma.sum.WPD.pdf

According to petitioner, “anytime you’re moving, you’re actually in business”. So, for example, “when you drive to the grocery store, you will transact business.”

In this regard, when asked by the Court “what part of the grocery store was most conducive to conducting his business”, petitioner replied as follows: I would say the meat section, where they have the chips and all that good stuff. That’s where people stop, and the fruit section; that’s where I, you know–and if you’re an agent and people know you’re an agent, they will stop you and you will–you know, just have a conversation with them. If they’re in the store and you pass a [business] card out.

THE COURT: I mean, do you wear a sign that says, I’m an agent, and stop them–- the deduction was disallowed. In the words of the court: “We find petitioner’s theorem regarding the transmutation of nondeductible personal expenses into deductible business expenses through kinesis to be so fundamentally flawed that we reject it without further discussion.”

…Happy Travels!

Recent Comments