Do you clearly understand the differences between the services of a bookkeeper and an accountant? Both are enormously beneficial to your business, it is important you understand the differences.

3 mistakes to avoid:

- Never expect a bookkeeper to do the job of an accountant

- Never hire an accountant to do your bookkeeping.

- Do not hand your accountant a shoe box of receipts at tax time.

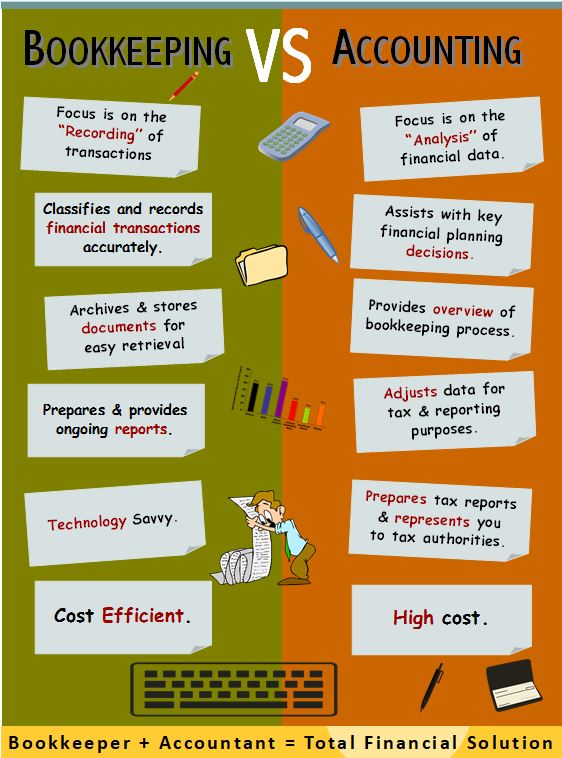

This chart outlines some key differences:

“WHY” Your Accountant Should Not Be Your Bookkeeper

1. A Bookkeeper is Less Expensive

The hourly fee of your accountant will be much higher than the services of a professional bookkeeper. Also, to hand your accountant a shoe box full of receipts at tax time, rather than a set of financials from your bookkeeper, will cost you.

2. Bookkeeping is Not Your Accountant’s Specialty

Accountants are best suited to “analyze” the data, to make adjusting entries, to help you with your tax return, to keep things organized and on the right track, to help you make good financial decisions. They are the engineers of your financials but they do not lay the sidewalk or paint the trim.

3. Best to have a System of ‘Checks and Balances’

When you have both a bookkeeper and an accountant involved, they BOTH can advise and catch items that are in error. Errors are reduced and you get a system of checks and balances that you do not get from just hiring an accountant.

Recent Comments