The IRS has rules that to relate to what types of business driving is eligible for a mileage deduction.(click here for IRS details)

A few TIPS for tracking mileage:

- Daily commutes from your home to your permanent work location do not qualify for a business mileage deduction.

- If you need to travel to a second work location that is not your primary office, you may be able to deduct your mileage costs.

- You can take a mileage deduction for travel to and from business conferences, off-site meetings, and business-related events, including lunches or dinners with current or prospective customers.

- You can also deduct your mileage if you travel to visit customers or use your vehicle to run business-related errands, such as obtaining supplies or getting documents notarized.

For 2017, the standard mileage rates are (click here for IRS details):

- 53.5 cents per mile for business, down from 54 cents in 2016

- 17 cents per mile for medical/moving, down from 19 cents in 2016

- 14 cents per mile for charity, the same as in 2016.

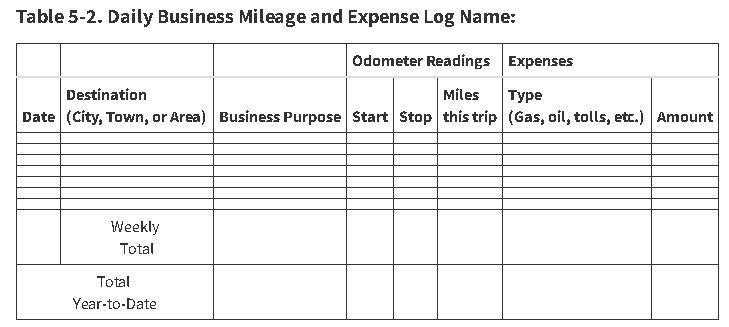

Here is the sample log (as provided by IRS)

* What is your method of keeping a log? ..do you use an app?.. paper log? Please comment what works for you?

Download a Free Real Estate Agent Tax Deduction Cheat Sheet click here.

Happy logging 😉

Recent Comments